“For savvy shoppers with a nose for a luxury bargain, Japan is proving hard to beat,” Bloomberg reported recently, noting that the drop in the yen has created a rare opportunity for consumers to grab luxury goods at a discount. The falling value of the yen compared to other currencies, such as the U.S. dollar and the euro, is not the only factor at play, though. The price tags of goods in Japan are particularly attractive for bargain-hunting buyers right now thanks to the enduring lack of price harmonization efforts by luxury goods brands.

Companies’ strategic alignment of prices of products and services across different markets and channels – which is known as price harmonization – has been a recurring topic of discussion in the luxury segment over the past decade or so, as big-name brands like Chanel and Cartier have sought to ensure that the price tags for their goods are approximately the same in different markets across the globe. However, despite a media attention to the practice of harmonized “global pricing” (including recent comments from Chanel CEO Leena Nair, who cited the brand’s desire to avoid price gaps between countries as part of the reason for its recurring price increases), the number of companies that have actually embarked upon fully-fledged price harmonization campaigns is relatively few.

Bloomberg name-checked TAG Heuer’s Carrera Chronograph watch as one example of a larger phenomenon of brands opting not to take price-correcting action in the face of growing price gaps. The LVMH-owned watch company’s Chronograph model currently sells for ¥785,000 ($5,087) in Tokyo (after the 10 percent duty free discount), which is quite a bit cheaper than the $6,450 price tag for the very same watch in New York thanks to the company’s decision “not [to] adjust its prices to reflect the change” in the value of the yen.

The Upsides of Uniform Pricing

Price harmonization, nonetheless, has been a widely reflected-upon topic. This is due, in part, to the enduring price increases that have been ravaging the luxury goods segment. There is also the potential value that such a pricing strategy stands to bring for brands. The adoption of globally uniform pricing has, for instance, been touted as capable of helping companies to maintain brand equity and a perception of fairness and consistency in pricing. Luxury market experts also frequently point to the maintenance of consumer trust as a driving force behind brands’ efforts to harmonize prices across international markets, particularly as e-commerce – and sites dedicated to tracking different types of luxury goods – have made it easier than ever for consumers to compare prices across different brands and products from all over the world.

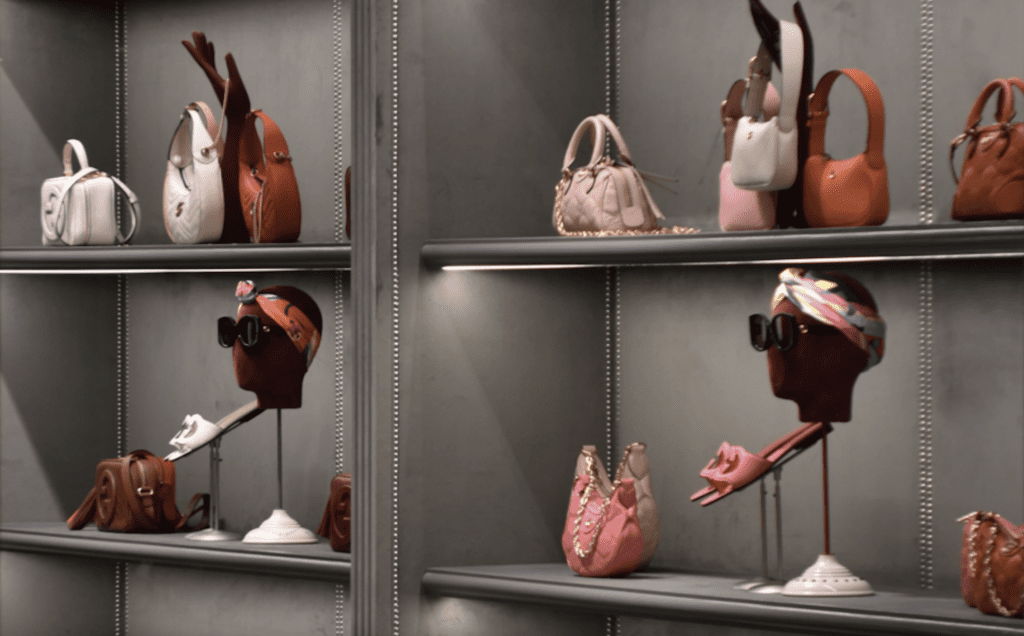

Against this background, it may not be ideal for brands to charge consumers in one market significantly more for their goods/services than those in others – after all, such a tactic may appear predatory. This has been an issue for luxury goods brands when it comes to China, for instance, where an overarching lack of price harmonization by brands – both before and after the pandemic – has meant that “some luxury [goods] prices have significant gaps [with] Europe,” Bain & Co. observed last year. The consultancy noted that “only a few luxury goods brands maintained global pricing strategies over the course of the pandemic,” meaning that for everyone else, the prices of leather goods in China, for instance, could be as much as 45 percent more expensive than in Europe.

Such pricing disparities not only serve to potentially alienate consumers in heavily impacted markets; they can create operational efficiencies and supply issues for brands and may also facilitate the existence of a robust grey market or system of parallel trade. The risk of parallel imports – which sees individuals and/or established resale entities buying goods in one market where prices are cheaper and then importing and reselling them in another for higher prices – “increases enormously” in these situations, per Deloitte, which has found that the rise of the grey market demonstrates that “the importance of price harmonization is often underestimated” by brands.

At the same time, for brands that are looking to get a handle on the secondary market, limited variations in the prices of their goods in different markets removes the incentive for consumers to purchase goods in one market and resell them in another – potentially at a markup. As such, companies that harmonize prices may be able to better incentivize consumers to purchase goods from their own retail networks – and not from resellers.

“Brands Haven’t Had To”

Despite the potential benefits that can be garnered from the implementation of global pricing strategies, most brands are not rushing to ensure that their prices are consistent across different markets. Bain & Co. noted this spring that a sample check of leading products in Europe, as well as in mainland China and other Asian markets, revealed “significant price gaps across categories, such as fashion and leather products.” Meanwhile, Deloitte previously observed that “a significant share of companies” do not have a “clear strategic approach” when it comes to global pricing or have opted to forego global price harmonization efforts altogether.

This raises the question of why – in the face of such potential benefits – brands are choosing to allow the prices of their goods to exist independently in different markets.

Part of the lack of action is likely driven by the fact that companies have never had to overhaul their pricing strategies in the past – either due to a lack consumer ire or a dearth of regulatory intervention, such as by the Chinese government, to ensure that foreign companies’ pricing architectures are not taking advantage of consumers. (The striking gaps between prices of luxury goods in brands’ home turf in Europe versus China has raised questions in the past (for us at least) about whether Chinese president Xi Jinping’s administration might put pressure on brands to narrow the price premium for luxury goods sold on the mainland to minimize unfair premiums for Chinese citizens.)

In reality, luxury brands have long faced pricing disparities between different markets, according to GAM’s luxury brands investment strategy manager Flavio Cereda, who states that in 2022, for example, U.S. tourists could “save a fortune [on luxury goods] by buying them in Europe as opposed to in the U.S.”

Given that this is not a novel phenomenon for brands and that the “fix” is often a complicated one (especially when considering the combined role of currency fluctuations, tariffs, taxes/duties, etc.), it is clear that most have focused largely on extremes, such as when price gaps exceed 50 percent. But even when faced with steep price differentials, brands rarely go back to the drawing board and overhaul their pricing on a global scale, which can be a large logistical lift and can pose potential risks in terms of pricing-related backlash. Chanel has proven to be a case study in the latter respect, garnering pushback from consumers on more than one occasion due to its consistent – and often eye-watering – price increases. (The company has reportedly faced threats of consumer boycotts, including in cases where such prince rises have been directly tied to attempts by management to standardize global pricing.)

In lieu of sweeping strategic efforts to ensure that prices are roughly uniform in markets across the globe, the best move by brands seems to come by way of targeted price increases in select markets if/when particularly excessive price gaps arise.

Unfortunately, even that is not always easy, per Cereda, who says that price increases can be “tricky for some brands to achieve” – depending on the brand and on the specific market. While certain luxury goods companies have been able to raise prices in markets around the world, this is not the status quo for all luxury brands thanks to market conditions. In other words, if brands do not command the requisite level of market demand (and pricing power) to pull off the price increases that harmonization often entails, such efforts may result in falling sales.

With that in mind, most brands appear willing to let prices stand on their own across markets – until they are given reason to change course.